Bacara Resort & Spa Acquired by Carey Watermark Investors & Carey Watermark Investors 2

For Release – September 29, 2017 – Carey Watermark Investors Incorporated (CWI 1) and Carey Watermark Investors 2 Incorporated (CWI 2), two non-traded real estate investment trusts (REITs) that invest in lodging and lodging-related properties, announced that they have acquired Bacara Resort & Spa. Strategically located on 78 oceanfront acres in close proximity to Santa Barbara and the Santa Ynez…

Carey Watermark Investors Inducted into Marriott International’s Partnership Circle Hall of Fame

NEW YORK – December 14, 2016 – The Carey Watermark Investors (CWI) series of non-traded real estate investment trusts focused on investing in lodging and lodging-related properties, announced that it has been inducted into Marriott International’s prestigious Partnership Circle Hall of Fame. The annual Partnership Circle Awards are the highest honor Marriott International presents to its hotel managers and owners…

Carey Watermark Investors Acquires The Equinox, A Luxury Collection Golf Resort & Spa

For Release February 18, 2016 – Carey Watermark Investors Incorporated (CWI 1) announced that it has acquired The Equinox Golf Resort & Spa, part of Starwood's The Luxury Collection brand. The expansive, historic resort is located on 1,300 acres between the Green and Taconic Mountains in Manchester, Vermont, and includes 195 guestrooms, 18,500 square feet of flexible meeting and event…

Carey Watermark Investors Acquires Remaining Interest in Fairmont Sonoma Mission Inn & Spa

For Release February 17, 2016 – Carey Watermark Investors Incorporated (CWI 1) announced that it has acquired from Fairmont Hotels & Resorts the remaining 25 percent interest in the Fairmont Sonoma Mission Inn & Spa, bringing its ownership of the property to 100 percent. CWI 1 acquired its original 75 percent joint venture interest from Fairmont in July 2013. Fairmont…

Carey Watermark Investors Acquires Le Méridien Dallas, The Stoneleigh

For Release November 23, 2015 – Carey Watermark Investors Incorporated (CWI 1) announced that it has acquired Le Méridien Dallas, The Stoneleigh. The historic hotel includes 176 guestrooms and is located in the chic Uptown Dallas district. Key Facts Newly renovated, historic building: Originally built in 1923, Le Méridien Dallas, The Stoneleigh is an iconic, AAA Four Diamond Art Deco…

Carey Watermark Investors Purchases The Ritz-Carlton, Fort Lauderdale Property in Joint Venture

For Release July 1, 2015 Carey Watermark Investors Incorporated (CWI 1) announced that it has acquired a majority interest in The Ritz-Carlton, Fort Lauderdale property in a joint venture with RCFL Holdco, LLC, an affiliate of Gencom, one of North America's leading hospitality and luxury hospitality-related residential real estate investment and development firms. This transaction marks Carey Watermark Investors' third joint…

Carey Watermark Investors and Carey Watermark Investors 2 Purchase The Ritz-Carlton Key Biscayne, Miami Property in Joint Venture

For Release June 1, 2015 Carey Watermark Investors Incorporated (CWI 1) and Carey Watermark Investors 2 Incorporated (CWI 2), two non-traded real estate investment trusts (REITs) focused on investing in lodging and lodging-related properties, announced that they have purchased The Ritz-Carlton Key Biscayne, Miami (the Ritz-Carlton) property in a joint venture with Gencom, the original developer of the property. The…

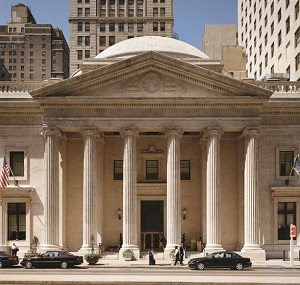

The Ritz-Carlton Philadelphia Acquired by Carey Watermark Investors in Joint Venture

For Release May 19, 2015 Carey Watermark Investors Incorporated (CWI 1) announced that it has acquired a majority interest in the 299-room Ritz-Carlton Philadelphia (The Ritz-Carlton) in a joint venture with Philadelphia Hospitality Partners, L.P., the owner of the property. Key Facts Historic property in premier Center City, Philadelphia location: Originally built between 1904 and 1908 as The Girard Trust…